There's a Hole in the Fintech Market

“The future is always sooner and stranger than you think.”

There is a huge, gaping hole in the Canadian fintech market, waiting to be filled in the not-so-distant future by some challenger. That challenger may sneak up on us, because they won’t be investing in ads - they’ll be investing in experience. If you’re gonna be a digital bank, you better have the best always-on digital experience. This is not just about awareness and leads - it’s about customer experience and innovation, across all customer touchpoints.

Source: Straight outta Mitchell Hunter’s big brain.

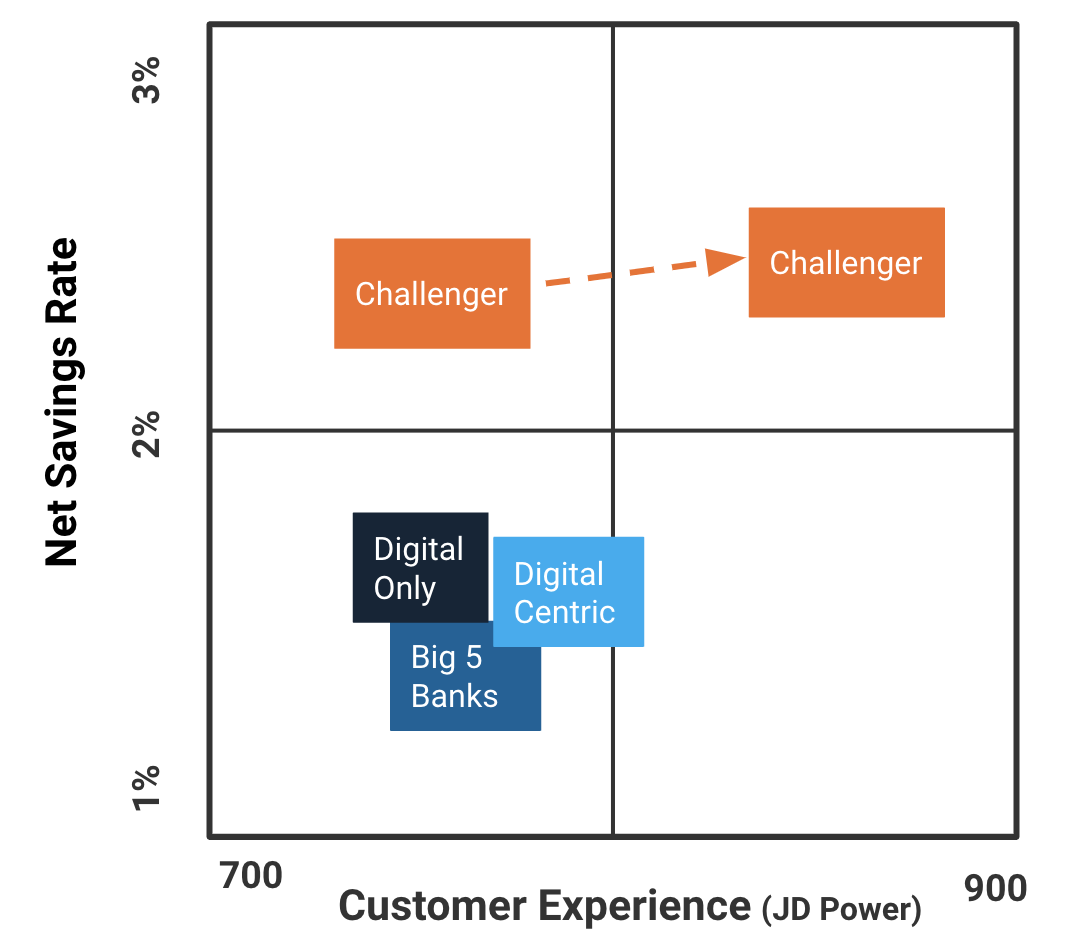

Here are the JD Power Satisfaction Ratings, on a scale from 0 to 1000. Truth is, bank customer experience has been circling around “oh, ok” for years. And, on average, digital-only banks have not improved on that - in fact, they’ve brought the satisfaction ratings DOWN.

Source: JD Power Retail Banking Satisfaction Study, 2018

That’s because fintech competitors, to their long-term peril, are either focused on rates and fees (effectively, “price”), or initial ease of use (“set up your account in minutes”). They are not focused on providing the best digital experience (service + product innovation + rates) across all customer touchpoints. And, for some digital challenger bank, that’s where the opportunity is.

The hole in the fintech market.

Digital banks should be able to attract customers with a consistently better rate, and that is a key part of a great digital experience. A quick glance at Ratehub shows you that of the 5 digital banks offering savings rates north of 2%, 3 of those are “teaser” rates - they drop to 1-1.5% or so after 6 months - right in range of the big 5 banks. Other caveats you can find on these offers include minimum balances, “new depositors only,” etc. It’s sort of like going to Shoppers to buy a new anti-wrinkle cream:

Let’s see, you can get a price freeze, or buy 2 get 1 free, or get 2,000 Optimum points, or get it on SALE! It’s hard to know where to look. Even better, as everyone knows, if you go on Thursdays, it’s Seniors Day at Shoppers, and that’s another 10% off. But you gotta wait ‘til Thurs. Pretty soon, you decide to just head to Walmart to buy a giant tub of SPF 50 sunscreen and a big floppy hat. Because it’s easier.

This is not making banking better. Digital banks, if you cannot consistently offer savings rates 1-2% higher than those big banks with hundreds of expensive branches, please turn in your digital merit badge, now. Your cost structure is millions of dollars lower. No teaser offers, no conditions. Just offer higher rates. Every day.

Next, let’s look at that ease of use promise. Take Wealthsimple. From a standing start just over 3 years ago, it has grown to over 65,000 customers with over $2 billion in assets, on a promise to make investing simple. Three weeks ago, I pressed the “Start Investing” button on Wealthsimple’s site, looking forward to opening an account faster than I could put on sweatpants. Over a week later, my account was up and running. That’s not close to best-in-class.

“Best in class companies target less than 20 minute response time for social customer care.”

The culprit? I am a dual US/Canadian citizen, so I ticked that box on their form. First they sent the wrong Wealthsimple forms, then the wrong IRS tax forms. All this happening with average response times of 2-5 hours or more, not 20 minutes. After the IRS form issue, the unfailingly positive, helpful and polite support rep sent me this:

“So sorry for that and thank you for pointing that out! I have requested for our engineers to resurface the agreements with the W9 forms.”

That brand voice and tone’s a little off. The fact that it takes engineers to “resurface” the correct forms does not scream “simple.” And two days after that, the engineers did get the correct W-9 form up there, I signed it, and we were off and running.

Wealthsimple IS a great idea. It was easy to set up a monthly auto-transfer from my main bank once the account was set up, and they invested my money in a diversified portfolio for me based on my risk tolerance. I’ll probably have the account for a long time - I like it. But it was definitely not simple to set up. And asynchronous care via the equivalent of email doesn’t help. Customers expect effective care responses in minutes on social. Even Revolut, the UK’s leading digital challenger bank (with 1.5 million customers gained in less than 3 years, and a fantastic Twitter gif/meme game) has its challenges with social care:

How can banks differentiate themselves from the “me too” clamour of the “high rates, easy to use” promise (which isn’t consistently delivered), and achieve the “great digital experience” brand position? Invest in the always-on digital experience, not ads or promos. What do we recommend? We’re not going to give away all our secrets, but here are a few concrete ideas:

Employ a social listening tool such as Spredfast or Sprout Social, so that a small care team struggling with 40%+ growth can respond quickly and effectively on social, which is where digital bank customers live.

Build a smart chatbot that can handoff intelligently to a human. This covers gaps in care hours if you can’t cover 24X7, and it reduces the load on human care reps.

Create brand voice and tone guidelines for social care reps, including approved content, emojis, hashtags, and the like. UK challenger bank Monzo has even posted their brand voice and tone guidelines online, for the world to see. Make sure these guidelines are consistent with marketing’s key messages.

Innovate based on what customers tell you they need. Use social listening tools, and make it easy for customers to submit questions online. Build microsites for key customer groups that encourage conversation and submission of product ideas. Monzo, with 700,000 customers on its mobile app, used community feedback to build a web interface which allows users to view transactions and freeze accounts in the browser.

Create highly personalized in-app offers using the power of artificial intelligence to analyze social text and images. HSBC recently sent me a photo of a grandmother playing with her grandkids, related to a “what are you saving for?” travel offer. This basic personalization (gender and birth year) missed the mark because a quick AI-enabled survey of my social posts would show that I have a 10 year-old and am much more likely to respond to travel offers for discount tickets to DisneyWorld.

It’s not easy. All this innovation can be risky and failures can be expensive. Banks have to be good risk managers in order to sustain profitable innovation over the long haul. We recommend measuring end-to-end business results of each project, from impression to closed sale. Refine what’s working, and kill what’s not.

End-to-end measurement system, Prophetly.

Does all this sound like science fiction? Nah. We’re with Reid. Somewhere out there is a Canadian digital bank, ready to make banking better by delivering a great digital experience through consistently higher rates, excellent always-on customer care, and relevant, customer-centric product innovation. Who is this mysterious bank? Stay tuned. The future is sooner than you think.